Let's Talk about Trip Insurance!

No one plans to get sick or injured on a trip. We get on the airplane, fly to our destination, and cross our fingers that our luggage made it every time - without giving much serious thought to what would happen if our suitcase really DIDN'T make it. And we rarely give much forethought to a natural disaster occurring partway through our trip that keeps us from flying home when we planned.

If you travel frequently, or for long enough, however - the unexpected and unplanned are bound to make an appearance sooner or later.

What is Trip Insurance?

Trip insurance, also sometimes known as trip/vacation protection, exists to help minimize risk. Like all insurance products, it can minimize your financial risk on a big purchase; typically, trip insurance also carries some medical and inconvenience benefits.

Why do people purchase trip insurance?

Vacations can be large purchases and often come with non-refundable components such as airfare or a lodging deposit. Many people who purchase trip insurance are looking for financial protection for those non-refundable costs if they are prevented from going on their trip.

The other frequently-cited reason for purchasing trip insurance is to provide medical benefits when traveling internationally. Even though medical care can be much less expensive outside the United States, it can still put a dent in a vacation budget if you end up in a hospital overseas. Trip insurance will often reimburse medical expenses incurred on vacation up to a certain amount.

Cancel for any reason vs cancel for a covered reason

One of the most important things to understand about trip insurance is what your policy covers in case you need to cancel your trip. Almost all trip insurance products will provide some form of reimbursement if you cancel for a COVERED reason; only some will provide coverage if you cancel for ANY reason.

Covered reasons vary from policy to policy, but typically include things like illness/injury of the traveling party or someone in their immediate family, natural disasters preventing you from traveling, accidents that occur on the way to the airport and cause you to miss your trip, pregnancy, getting called up to military service, and other similar reasons. Some policies even cover things like finding out you have to work after you’ve already booked your trip or attending the birth of a close family member. It’s always smart to check the fine print closely to read what is considered a covered reason. If you cancel your trip for a covered reason, you will likely need to provide some documentation to the insurance company to support your cancellation reason; the insurance company will review the documentation and then issue reimbursement for your lost funds. In most cases, this will be in the form of a check or direct deposit; in rare circumstances, you may receive a voucher for future travel.

Cancel for any reason coverage is different. When canceling for a reason other than those specifically listed as covered, you would be using the “CFAR” coverage. Maybe you’ve changed your mind about traveling, the weather looks really crummy, or you have a sudden large expense that means you can’t take your trip; whatever the reason, you cancel your trip and file a claim with your insurance company. The company will review your claim and then issue your refund. With CFAR coverage, many times the refund is only for a percentage (75% is common) of the total trip cost and it will sometimes come in the form of credit towards a new vacation rather than a cash refund. Cancel-for-any-reason policies with a full cash refund are the Cadillac of trip insurance policies; if this is the type of protection you’re looking for, be sure to read the fine print carefully and expect to pay a higher premium for this coverage. Note: A few states, like New York, do not allow residents to purchase CFAR insurance.

In both instances, refundable costs are not covered by trip insurance. For example, if you booked a hotel that allows you to cancel up until the day before you travel and you cancel your trip five days before you’re supposed to leave, you should expect a refund from the hotel and would not be able to file a claim for that cost under your trip insurance policy.

Airfare is where it gets really complicated. Technically speaking, most economy-class airplane tickets are non-refundable in the sense that you will not get a cash refund if you cancel your flight. As long as you don’t book a basic economy flight, however, you should be able to retain the value of that ticket to use towards a new flight sometime in the upcoming year. Since the airfare is non-refundable, it MAY be covered under a cancellation policy in your trip insurance. Again, read the fine print carefully before you purchase to make sure you understand what’s included.

A side note, after your free-look period (more about this later), the cost of the trip insurance itself is NOT refundable!

Medical coverage

Almost all trip insurance policies include at least some medical benefits for travelers included on the policy. There are even medical-only policies that you can buy for super cheap if you ONLY need the medical portion of trip insurance.

In most cases, the medical coverage includes things like doctor’s visits, prescribed medicines, hospital stays, emergency evacuation, necessary medical treatments, and so on. Many policies will also pay for a flight for one person to come to be by your bedside if you’re too unwell to travel or pay for your travel companions to get home without you if you’re stuck in the hospital. Some policies also include emergency dental work, replacement eyeglasses, and so on. Hopefully, you’ll never need it, but the medical provision typically also covers death and repatriation of remains.

If you are on a covered trip and have any medical-related problems, I strongly recommend that you keep your receipts and file a claim for reimbursement when you return.

Other Coverage

Most trip insurance policies also come with a whole host of rarely-used benefits, including things like:

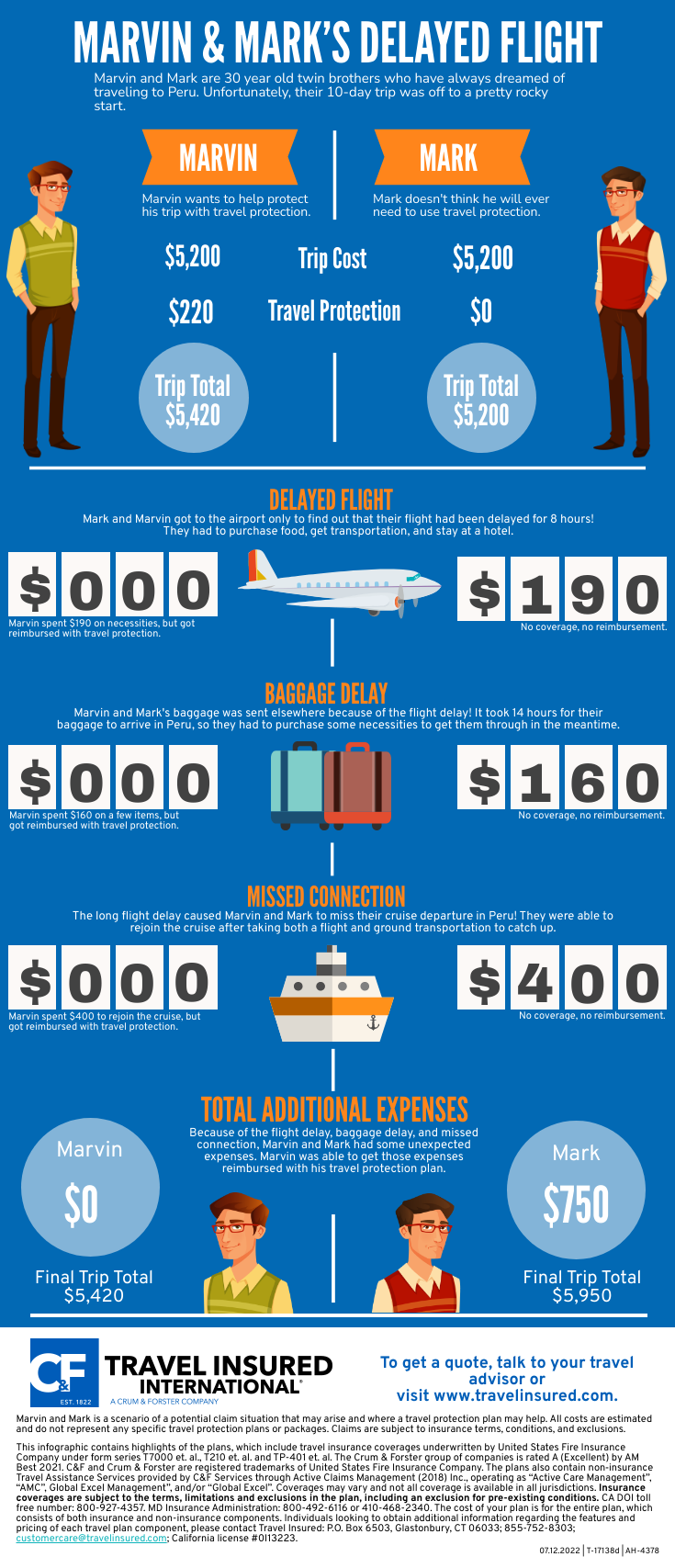

- Trip delay insurance - covers the cost of food, lodging, and incidentals in case your flight or other transportation is delayed more than a certain amount of time (usually 6 or 12 hours)

- Missed connection insurance - covers the cost of getting you to the point of joining your tour/ship if you miss your connection and therefore miss embarkation

- Baggage loss/delay - If your bags are late in arriving, or don’t ever arrive, covers the cost of replacement items up to a certain amount

- Passport replacement services - will assist you in getting your passport replaced in an emergency situation (you may still have fees associated)

- Damage to a rental vehicle

- “Travel inconvenience” - covers things like you scheduled a beach vacation, and it rained the entire time. If you can prove this with weather reports, you may be entitled to partial reimbursement. Likewise, things like sudden theme park closures, canceled tours, and so on are typically covered by this provision.

- Theft or loss of items, including electronics (like a laptop or phone)

If any or all of these features are important to you, it’s critical that you read the fine print before purchasing a trip insurance policy.

Where do I buy it?

There are usually a few options for purchasing trip insurance: through the vendor of your vacation package, independently from an insurance company, or utilizing trip insurance benefits on one of your credit cards.

Using your credit card’s insurance. This is my least-recommended option for trip insurance, although it can work in a pinch. In most cases, you have to have paid for your entire trip with your credit card in order for you to use the trip insurance benefits associated with that card. A few cards only require that you pay for part of your trip with your card. Check the coverages and fine print carefully, and make sure that the benefits align with what you’re looking to protect before relying on these products for trip protection.

Through the vendor of your vacation package. In some circumstances, this is the option that makes the most sense. If you’re buying a cruise from Princess, for example, it may be worth looking into the cost of the Trip Protection Plan through Princess Cruises. Often, these plans are less expensive than buying third-party, especially if you want to include a “cancel for any reason” option. There are a couple of caveats, however. First, some vendors offer coverage only for components booked through that vendor. For instance, using our Princess Cruise Line example, flights booked independently through American Airlines would NOT be covered by Princess’s Vacation Protection; flights booked on American Airlines but through Princess’s air department WOULD be covered. Second, check the cancellation terms carefully. Many vendor vacation protection plans offer refunds in the form of future trip credit instead of cash; some vendors offer a higher-level (and more expensive) form of trip protection that provides a cash refund instead. If a cash refund is important to you, make sure you know which option you’re buying.

Through a third-party company. In this option, you would purchase a trip insurance policy straight from an insurance company, such as Allianz or Travel Insured. Third-party trip insurance policies are best when you are putting together a trip with components from many different vendors (say, an airline, a hotel, and a cruise line), when you need some additional or niche coverage, you only need medical coverage, or you’re a frequent traveler looking for an annual plan. Many travel agents (self included) can assist in the process of finding and purchasing third-party travel insurance.

When should I buy it?

The best time to buy travel insurance is as soon as you have paid a deposit on your trip. If you are looking for cancel-for-any-reason coverage, you typically MUST purchase the insurance within a set amount of time since paying the deposit (most often 14 days). If you don’t need cancel-for-any-reason coverage, you can typically add it up until the date your final vacation payment is due. Some third-party trip insurance can be purchased until the day before travel!

You cannot typically buy trip insurance after you have departed on your trip.

Almost all trip insurance products come with a “free-look” provision. This means there is a period of time after you purchase the insurance where you can change your mind and cancel the insurance for a refund. Because of this, adding on the insurance when you book is a really low risk!

Mistakes people make when buying trip insurance

Besides not buying it at all, here are the most common mistakes folks make when considering trip insurance:

- Not understanding the cancellation policies and subsequently buying too little (or too much!) coverage. If you know you’re going on the trip unless you’re literally on death’s door, you do not need to purchase the more expensive cancel-for-any-reason insurance! Conversely, if you want the flexibility to just change your mind about traveling, you MUST purchase the cancel-for-any-reason option. During the peak of covid, this became a big issue: being unable to travel because you CAUGHT covid was a covered reason that insurance companies would pay for, but canceling a trip because you were afraid you MIGHT catch covid would have only been covered under a cancel-for-any-reason provision.

- Including refundable items in the trip cost. If you’re shopping for third-party insurance, keep in mind that you only need to include NON-refundable costs in your trip cost estimate. Because the price of trip insurance is based on the cost of your trip, adding these items in will make your trip insurance premium higher. Only add the cost of the money you’d lose if you had to cancel your trip at the last minute when shopping for trip insurance.

- Assuming your current medical insurance works overseas or on a cruise ship. Fun fact, the sick bay on a cruise ship is NOT free! Additionally, any costs incurred in the ship’s infirmary are most likely NOT going to be covered by your normal home health insurance. Your health insurance (including Medicare) also likely will not cover you overseas, and it definitely will not include some high-risk activities like skydiving or free diving past a certain depth. Even things like skiing off-piste can impact your coverage! If you’re traveling internationally, double- and triple-check your existing health insurance to be sure you’re covered in case of a medical emergency.

- Waiting too late to buy the insurance. We’ve already discussed the fact that you need to buy your trip insurance within a certain amount of time after making the deposit. There are other provisions that have time limits as well. The most common has to do with hurricanes. You cannot wait until there is a named storm impacting (or potentially) impacting either your home or your destination to purchase trip insurance if you want to file a claim based on a hurricane, for example.

What else should I know?

If you’re a frequent traveler looking for basic coverage, including medical, an annual plan like this one from Travel Insured is a real bargain. It’s also the product I carry for myself personally!

Vacations are investments of both time and money; purchasing trip insurance can really help you have peace of mind knowing that your investments are protected should you encounter a worst-case scenario.